Transforming customer experience in a bank requires bringing stakeholders from distribution, product, risk, legal, pricing, and other departments to the table. Regular risks include potentially conflicting agendas or timelines. Resolving these barriers requires active sponsorship from the top.. Banks and non-bank financial institutions are shifting their focus away from rationalizing product offerings toward a cohesive, simple, and personalized customer experience, in an attempt to re-gain the trust of the public, and to re-build customer loyalty following the financial crisis. Yesterday's demands—including flexibility, efficiency.

5 Strategies To Improve Customer Experience In Banking Maclocks Blog iPad Enclosures

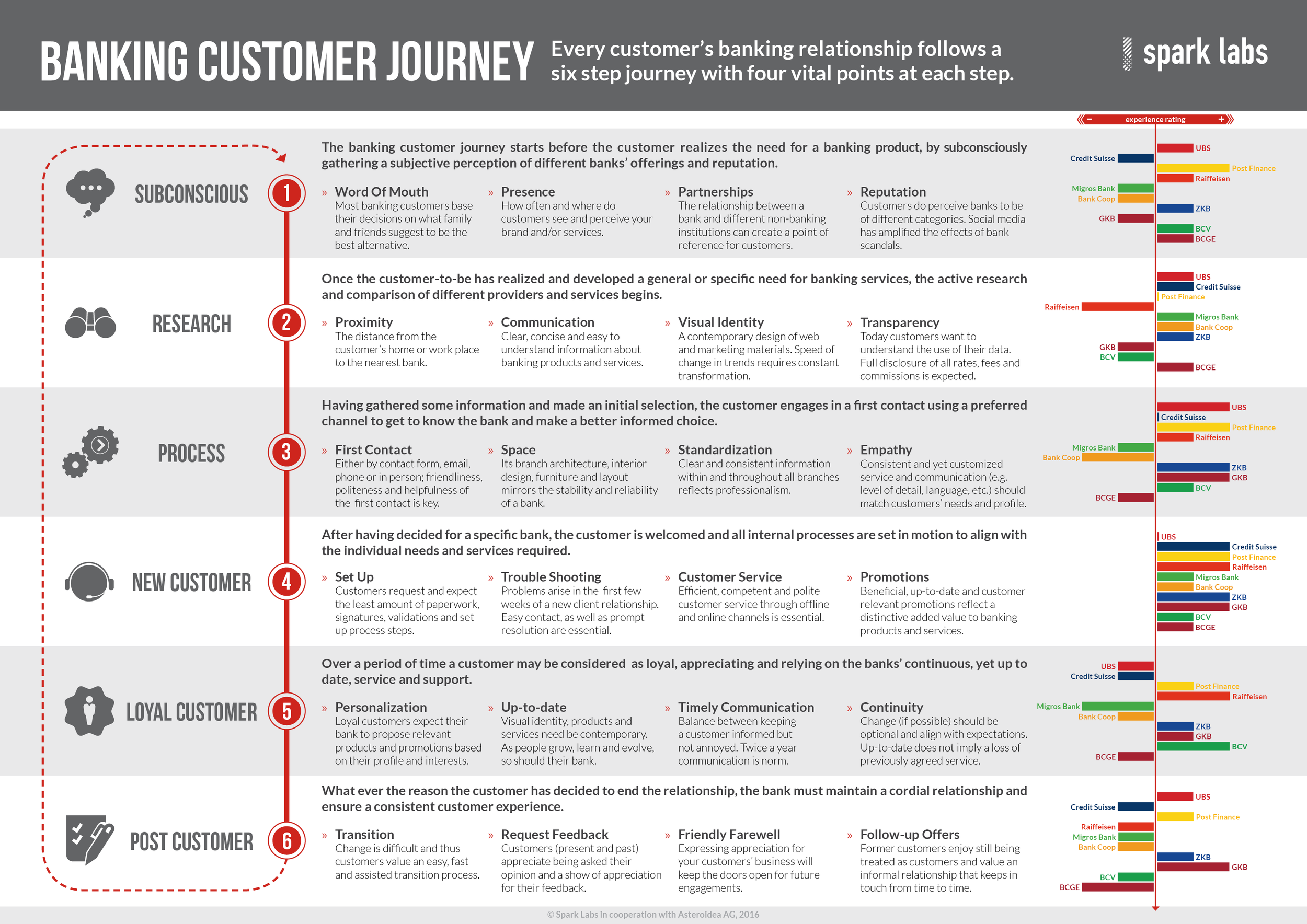

Infographic the banking customer experience BFC Bulletins

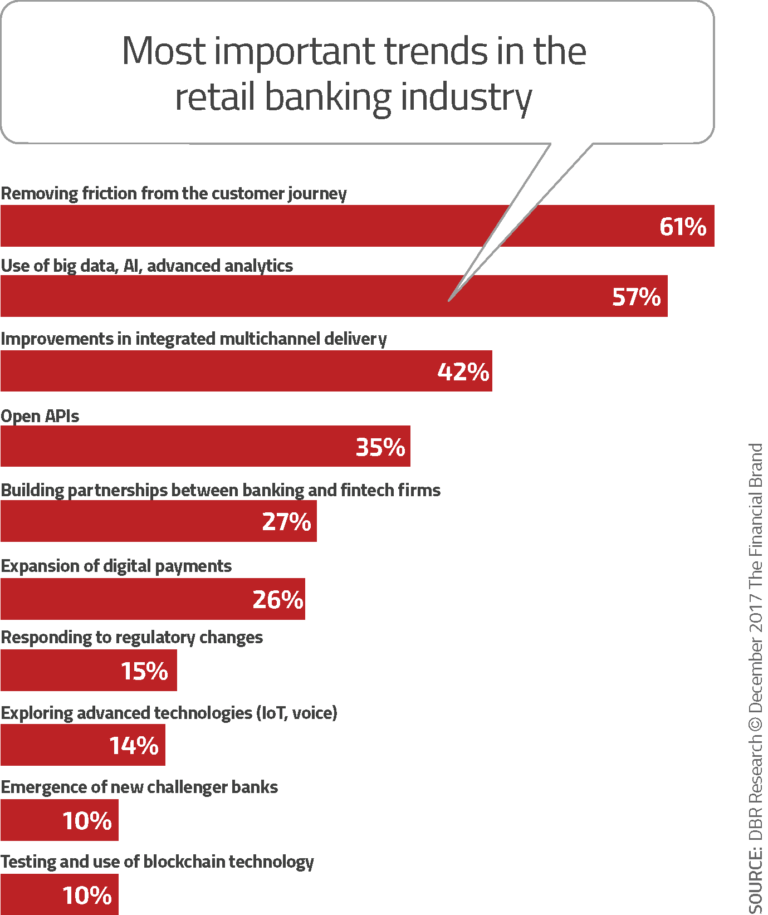

9 Trends That Define Customer Experience in Banking in 2021 Aspire Systems

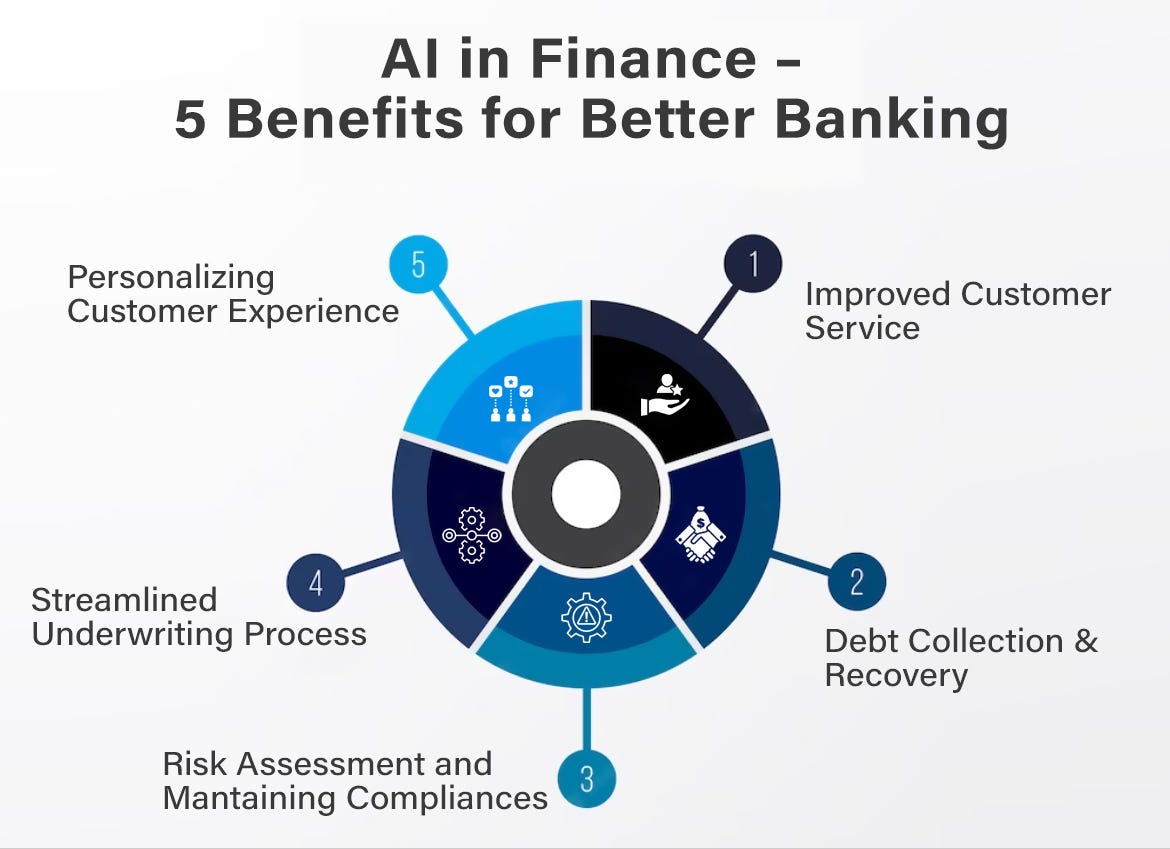

AI in Finance — 5 Benefits for Better Banking by MatthewMcmullen Towards AWS

How Banks are Transforming the Customer Experience

Customer Experience in Banking & Finance Industry GBW Sonata

Adapting to the Needs of Digital Banking Customers

Customers Expect Banking Experience to Be Seamless The MSR Group

Improve Customer Experience in the Banking Industry YUJ Designs

5 Reasons Customer Experience Matters In Banking

Customer experience un desafío para las empresas B2B

Banking with Salesforce How to Improve Customer Experience

How to improve customer experience in banking? Omoto

Great Digital Banking Customer Experience Gives You More Profit Allizine

Empower the customer journey without any obstacles to determine consumer retention and loyalty

Infographic the banking customer experience BFC Bulletins

Banking Customer Journey — Spark Labs

Modernizing and Optimizing Customer Experience in Banking What’s Next

Customer Experience in the Banking Industry XM Institute

Building value with exceptional customer experience in banking sector BlinkingID

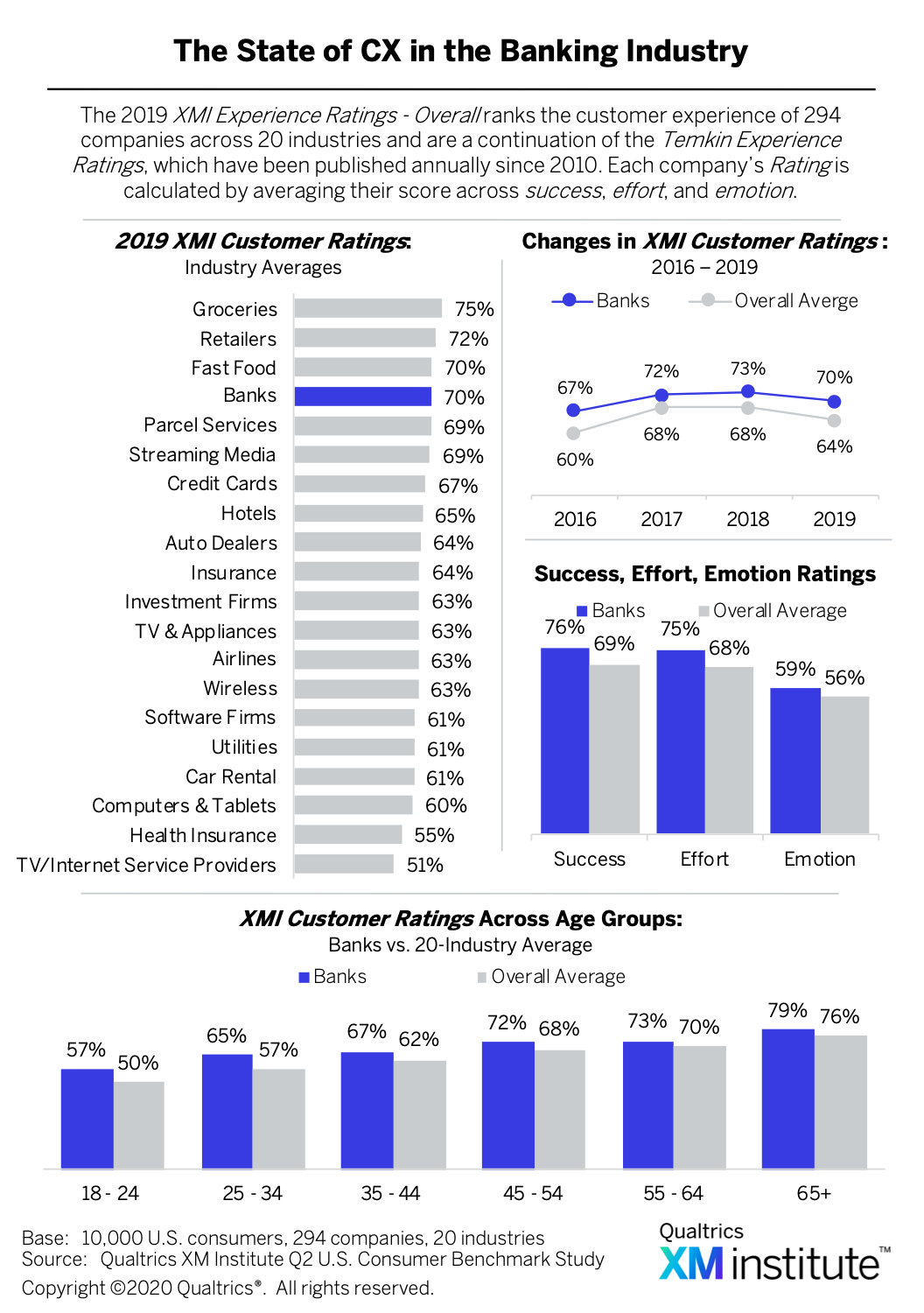

The banking industry's strategic emphasis on customer experience is not going unnoticed by customers. Banks received an overall XMI benchmark rating of 70%, tying for third place out of the 20.. Here are the top banking CX trends steering the future of finance. 1. Increased desire for high-quality mobile and digital banking. Mobile banking provides customers with the freedom to manage their finances anytime, anywhere—from checking account balances and transferring funds to paying bills and applying for loans.